Deer And Car Collisions

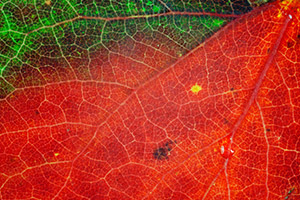

Oh Deer! Fall Brings More Activity

Deer-related collisions have been on the rise, with most happening in the month of November. The months of October and December rank second and third for deer collisions, respectively.

The coverage that would pay on a covered deer-hit claim is comprehensive. Generally sold together with collision, these two coverages make up the physical damage portion of your auto insurance policy.

Check to see if you have the coverage in place that you need, and also check the deductible amount. Remember, the deductible you choose is the amount of money you’ll pay out first, before the insurance company pays on a covered claim. Make sure you can afford the deductible you’ve chosen.

And, when you see a deer on the road, slow down and look for others; they generally travel in groups.

Contact us for all of your insurance needs!

Illinois and Wisconsin residents, at R Hobbs Insurance Agency, we can work with you to make sure you’ve got the coverage you need, while at the same time using all possible credits and discounts to make that coverage affordable. Just give us a call at (847) 680-0888 or send us a note at [email protected]. We want to help you meet your goals, and make sure what’s important to you is protected!